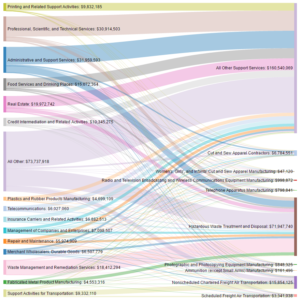

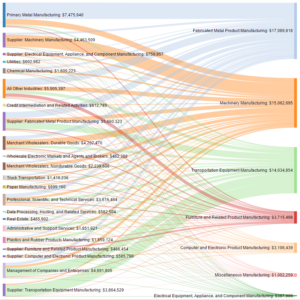

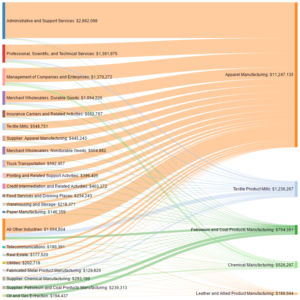

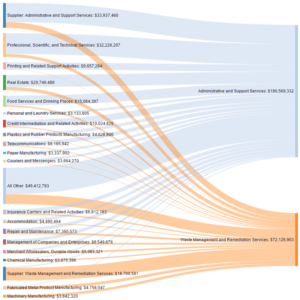

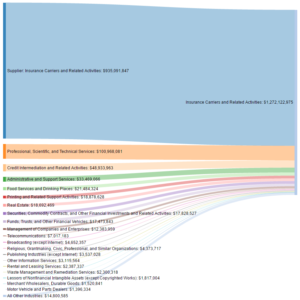

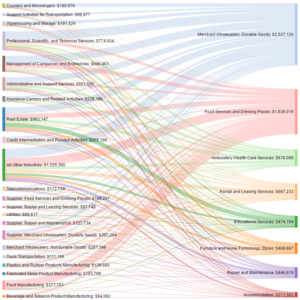

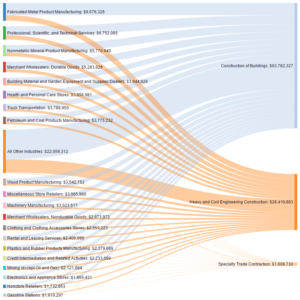

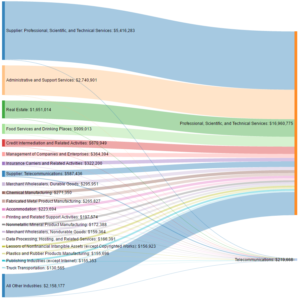

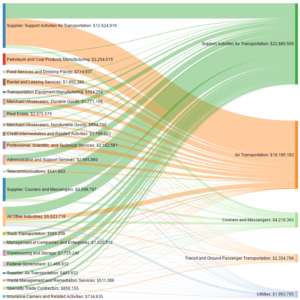

The Sankey diagrams below display supply chain flows from Kentucky’s defense supplier industries to purchasers.

Kentucky’s contracting industries are shown as purchasers on the right side of each diagram, with their suppliers on the left. Supply chain flows are based on industry purchasing estimates from Economic Modeling Specialists International (Emsi), weighted by actual contracting activity between FY12 and FY15. Unless otherwise noted, all industries displayed are based on the 3-digit NAICS level. The first diagram displays the supply chains of industries that are highly dependent on DoD contracts for their Kentucky-wide sales, while all other diagrams show the supply chains of the top 20th percentile of contracting industries—broken up into broad industry groups.